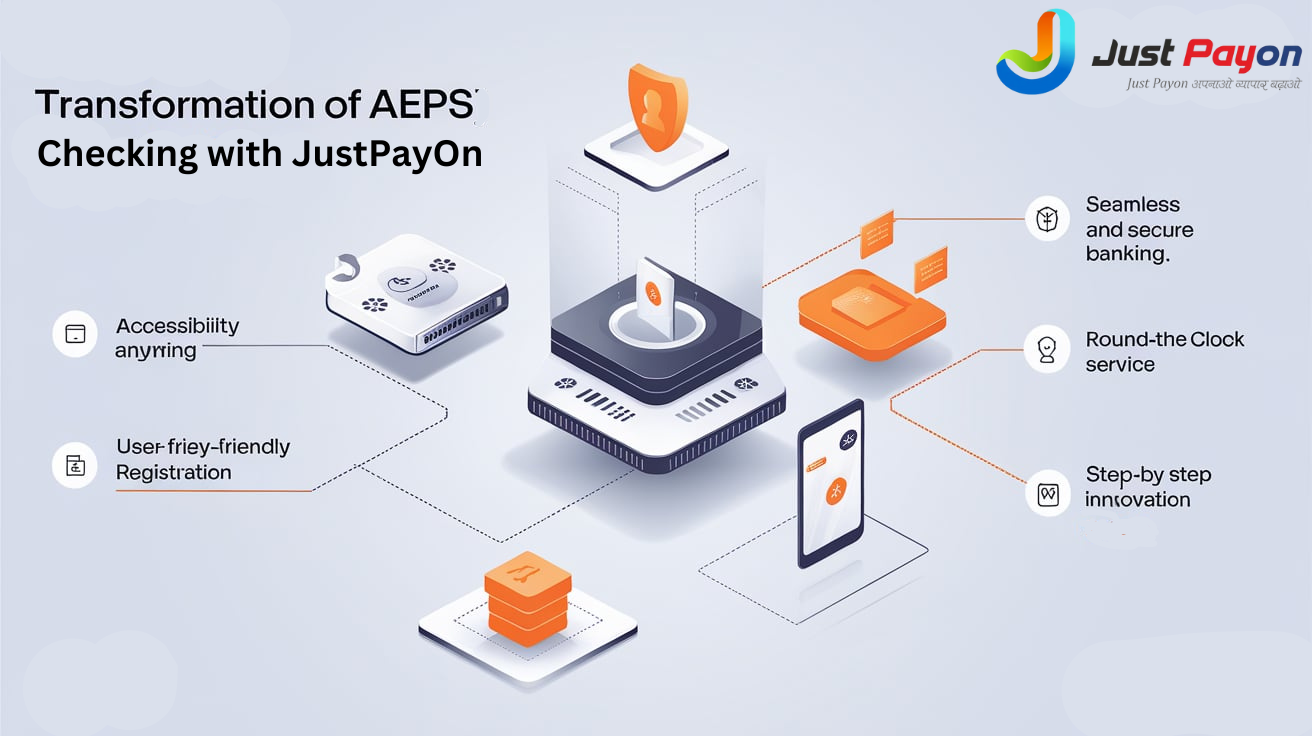

Transforming AEPS Balance Checking with JustPayOn: A Seamless and Secure Banking Experience

In today’s fast-paced world, convenience and accessibility are at the forefront of technological advancements, especially in the realm of banking. The Aadhaar Enabled Payment System (AEPS) has revolutionized the way individuals interact with their bank accounts, offering an innovative solution that bridges the gap between digital and traditional banking. Among the various platforms offering AEPS services, JustPayOn stands out by making balance checking and other financial transactions more accessible, secure, and user-friendly. Whether you’re in a remote village or a bustling city, JustPayOn ensures that managing your finances is always just a few clicks away. This blog explores how JustPayOn is transforming AEPS balance checking by providing a seamless, efficient, and reliable banking experience for all.

Contents of the Blog:

- Understanding AEPS: Definition and Full Form

- Challenges in Traditional AEPS Balance Checking

- JustPayOn: Revolutionizing AEPS Balance Checking

- Features of JustPayOn: Best AEPS Portal

- How JustPayOn Improves Financial Inclusion with AEPS

- A Deep Dive Into the AEPS Registration Process on JustPayOn

- Conclusion: Why JustPayOn is the Best AEPS Portal

Understanding AEPS: Definition and Full Form

AEPS, which stands for Aadhaar Enabled Payment System, is a revolutionary payment method in India that leverages the Aadhaar card to facilitate banking transactions. The main objective of AEPS is to empower citizens by providing them with easy access to banking services, especially those residing in rural and remote areas.

AEPS (Adhar Enabled Payment System) is a product launched by NPCI (National Payment Corporation of India). AEPS provides the adhar to adhar functionalities, cash deposit, balance enquiry, cash withdrawal etc. Digital India initiative provides AEPS as a cashless transaction. AEPS is the bank-model that allowed all customers perform financial transaction using their adhar number. AEPS service is required only adhar number and your finger authentication, and you provide adhar number that linked with your bank account. In future AEPS service is mainly used for all online transaction. It uses the Micro-ATM for AEPs transaction.

Challenges in Traditional AEPS Balance Checking

AEPS, or Aadhaar Enabled Payment System, has significantly transformed the financial inclusion landscape in India. However, traditional methods of AEPS balance checking have posed several challenges for users. One of the primary issues is the lack of accessibility. Users often need to visit banking correspondents or specific ATM machines, which may not be readily available in rural or remote areas.Users are required to input sensitive information, which can be vulnerable to unauthorized access and fraud if not handled properly. Traditional systems may not always have the best security measures in place, leaving users' financial information at risk.

- Limited Accessibility: Users often need to visit specific banking correspondents or ATM machines, which may not be available in remote areas.

- Security Risks: Sensitive information input may be vulnerable to unauthorized access or fraud if not properly secured.

- Manual Processing: Traditional methods can involve long waiting times and paperwork, making the process less efficient.

- Technological Barriers: Users with limited technical knowledge may struggle to navigate complex systems, making it difficult for some to access their accounts.

- Limited Availability: Banking services may not be available 24/7, restricting when users can check their balance or perform transactions.

JustPayOn: Revolutionizing AEPS Balance Checking

AEPS, or Aadhaar Enabled Payment System, has brought a significant transformation in the way financial transactions are conducted in rural and urban areas.

- Seamless Integration for Users:JustPayOn provides a seamless user experience by allowing individuals to complete their AEPS registration online for free. This eliminates the need for lengthy paperwork and reduces the waiting period.

- Enhanced Security Features: The portal leverages robust security measures to protect user data and transaction details. With features such as biometric authentication, users can be assured that their information is safe.

- User-Friendly Interface: The user-friendly interface of JustPayOn is designed to cater to users of all ages and technical abilities. Whether you are tech-savvy or a novice, JustPayOn’s straightforward navigation ensures that checking your AEPS balance is a smooth process

- 24/7 Access and Support:JustPayOn offers round-the-clock access and support for AEPS services. Users can check their balance, make withdrawals, and perform other transactions at any time, from anywhere.

More information Click Here!!

Features of JustPayOn: Best AEPS Portal

AEPS, or Aadhaar Enabled Payment System, revolutionizes the way financial transactions are conducted using Aadhaar authentication. At JustPayOn, we bring together innovative and convenient features to transform AEPS balance checking into a seamless experience.

- Seamless AEPS Balance Checking: With JustPayOn, AEPS balance checking is made extremely user-friendly. Our system is designed to provide instant balance updates, ensuring users have real-time access to their account information.

- Quick AEPS Registration Online Free: Users can quickly sign up without any hidden charges, enabling them to start using the best AEPS portal without any financial barriers.

- Optimized for the Best AEPS Portal Experience: JustPayOn is optimized to be the best AEPS portal, offering a suite of features that cater to various needs. From secure transactions to efficient customer support, every aspect is designed to provide unparalleled service.

How JustPayOn Improves Financial Inclusion with AEPS

JustPayOn’s innovative AEPS balance checking system plays a pivotal role in promoting financial inclusion, particularly in rural and remote areas where access to traditional banking services may be limited. By enabling users to perform banking transactions using only their Aadhaar number and biometric authentication, JustPayOn allows individuals without smartphones or internet connectivity to access their bank accounts. This democratization of banking services empowers people across India, offering them an easy, secure, and accessible way to manage their finances.

A Deep Dive Into the AEPS Registration Process on JustPayOn

Getting started with AEPS on JustPayOn is simple and hassle-free. The online registration process is designed to be quick, with no hidden charges. Here’s a breakdown of the registration process:

- Visit the JustPayOn Website:Navigate to the official JustPayOn website or mobile app to begin your AEPS registration.

- Provide Basic Information:Users are required to provide their Aadhaar number and some basic personal details such as their name, address, and contact information. The system cross-checks the details with government databases to authenticate the user.

- Biometric Verification:As a crucial step in the process, users undergo biometric verification to ensure that they are the rightful owner of the Aadhaar number. This step adds an extra layer of security and helps prevent unauthorized access.

- Set Up Your Account:Once verified, users can create an account on the platform. The process involves setting up login credentials, securing the account, and agreeing to the terms and conditions of the service.

- Ready to Use:Once your registration is complete, you can start using the AEPS services offered by JustPayOn, including balance checking, withdrawals, and transfers.

Conclusion: Why JustPayOn is the Best AEPS Portal

JustPayOn has positioned itself as a leader in the AEPS space, offering an easy, secure, and innovative platform for checking AEPS balances. Whether you are a first-time user or an experienced individual, JustPayOn’s intuitive design and robust security features ensure a smooth, hassle-free experience. The integration of cutting-edge technology with user-centric features makes JustPayOn the ideal choice for those looking for a reliable AEPS portal. By enabling users to access their banking services with just an Aadhaar card and a fingerprint, JustPayOn is helping to shape the future of digital banking in India, fostering greater financial inclusion and ease of access for everyone.